Auctions

Auction Types

The English Auction

Most common type of auction, an open, ascending-price auction.

Open meaning other bidders can see what is being bid, and ascending-price meaning that the bids are increasing.

The auctioneer gives a starting bid, and will reduce until someone accepts it, then bidding starts.

The Dutch Auction

Used to sell flowers in Holland. Open, descending-price auction.

The auctioneer announces an opening price, and decreases it over time. It’s sold to the first person who accepts a price.

Much quicker to run than English auction.

First-price sealed bid auction

Commonly used for property sales in Scotland.

Auctioneer announces auction is open, and how long it will be open for. Each bidder makes one secret bid. Bids must be submitted by close date. At close, the auctioneer opens the bids and the highest bidder wins.

Second-price sealed bid auction

Commonly referred to as Vickrey auction, who won a Nobel prize for his research in the area.

Bidders make one secret bid, and the winner is the person with the highest bid at close, however they pay the second-highest price instead of their price.

Auction Theory

Auction theory allows us to consider questions such as:

- Why are auctions and competitive bidding so prevalent?

- Are there situations to which an auction is particularly suited compared to a fixed price?

- What are good bidding strategies for bidders?

- Are particular forms of auctions likely to bring more revenue for sellers?

Auctions offer perfect First-Degree price discrimination.

Auctions have been used since antiquity (c.500BC).

They’re used because the seller is unsure of the value that bidders attach to the object being sold.

Bidder Value Models

Private values (independent)

- Refers to the value that each bidder considers the object to have to themselves.

- No bidder has certainty of other bidders’ values.

- Knowledge of other bidders’ values has no effect on the private value of the bidder with that knowledge.

This is most plausible when products are valued exclusively by its consumption or use, e.g. a slice of pizza.

Interdependence

Most plausible for objects that are possibly going to be re-sold after the auction.

How much the object is worth may be unknown at the time of auction to the bidder. Bidders may only have an estimate based on some private information.

Other bidders could have some secret information that might increase the value of the object.

We call this interdependent values: values are unknown at the time of auction and may be affected by information available to other bidders.

Equivalence

Bidding a certain amount in a first-price bid sealed auction is equivalent to offering to buy at that amount in a Dutch auction. Therefore the two auction types are strategically equivalent.

Two games are strategically equivalent if that for every strategy in one game, that strategy exists in the other game with the same outcomes.

In an English auction, the optimal bidding strategy is to bid up to the value that you consider the item to be worth.

In a SPSB auction, the optimal bidding strategy is the same, since the gamble of making a bid above the value trying to be the final bidder is countered by the risk of then having to pay above the value and making a loss.

SPSB and English auction is considered weakly equivalent, because they are only strategically equivalent if values are private.

If the values are interdependent, then in an English auction, seeing some other bidder drop out may cause a bidder to reduce their own estimate of the object’s value.

Incentive Compatible

An auction is incentive compatible if it encourages bidders to bid their true value (i.e. bid truthfully).

English and Vickrey auctions are incentive compatible.

Dutch and FPSB are not, since the optimal strategy is to shade, by bidding lower than your true value. E.g. in a Dutch auction, bidders try to guess the value other bidders place on the good, and attempt to bid just before that.

In an FPSB you may value a good highly, but if you know that others will value it lower, then you will try bid that lower value.

Incentive compatible auctions stop game-playing between bidders.

Revenue Equivalence Theorem (RET)

In English/Vickrey auctions, bidders bid honestly, while in Dutch/FPSB they bid .

However, the expected revenue in a FPSB auction is the same as in a Vickrey auction.

In fact, the RET states that if private values are independent, and all bidders are risk neutral, then any standard auction (such that the bidder who bids the highest amount wins) yields the same expected revenue to the seller.

Risk neutral means that all bidders only seek to maximise expected profits, and don’t attach an emotional aspect to the object. In reality, many bidders are risk averse and don’t want to miss out on the object.

When we take into account risk averse bidders, a FPSB auction yields higher revenue.

The RET also depends on independent private values, which is often not true. When we take interdependence into account, we find that ordinary ascending auctions are more profitable than FPSB auctions, since other bidders bidding tends to increase people’s private values.

Real-world vs theory

Klemperer’s article Using and Abusing Auction Theory shows some of the cases where the theory breaks down.

Two key implicit assumptions of RET are:

- All auctions are equally attractive

- There’s no collusion between bidders

The fewer bidders, the worse chance of getting the correct value.

In ascending auctions, strong bidders can always beat weak bidders, so weak bidders are less likely to enter. However, in a FPSB, a weak bidder may win at a price the stronger bidder could’ve beaten, but didn’t because they chose to shade.

Collusion

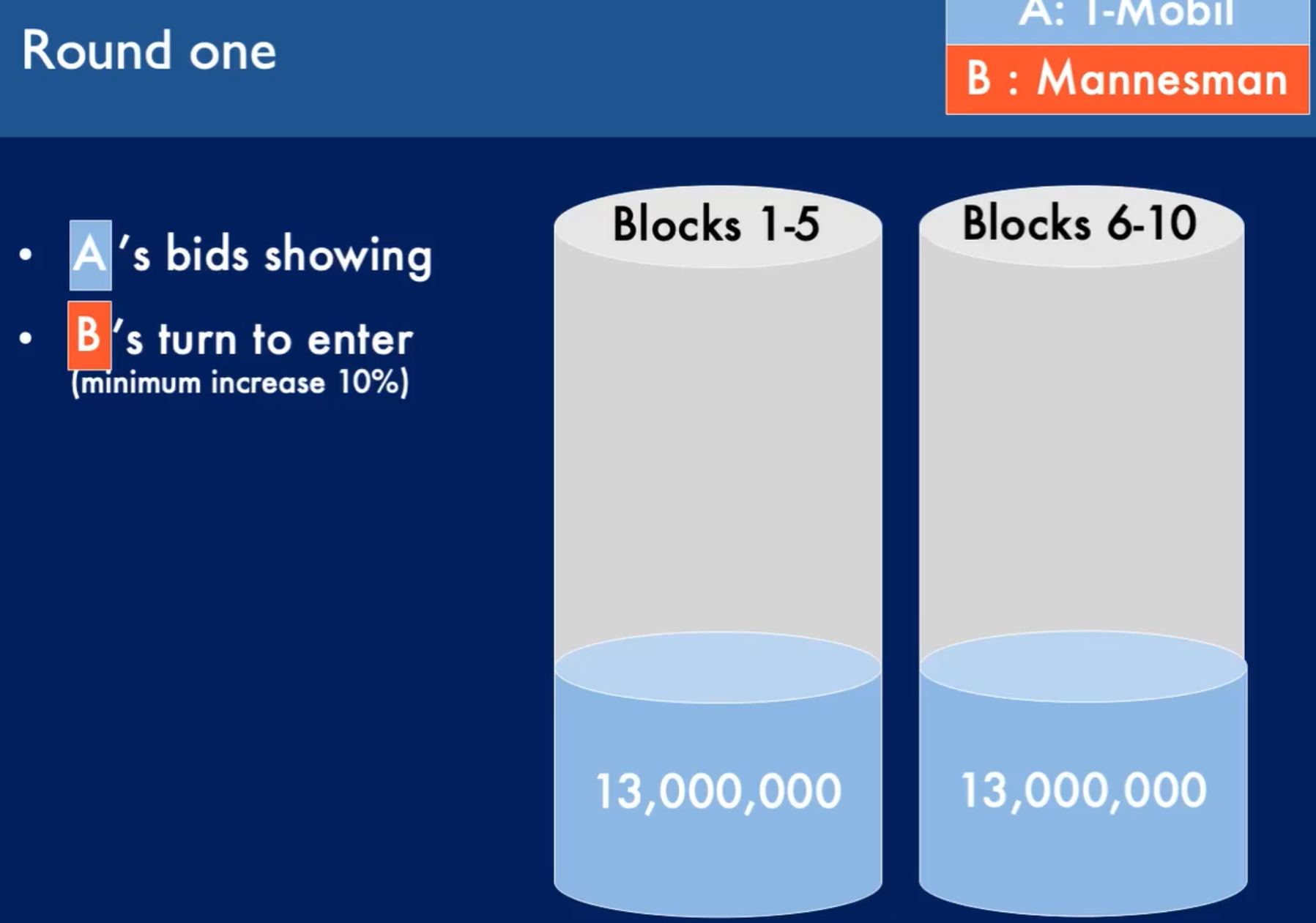

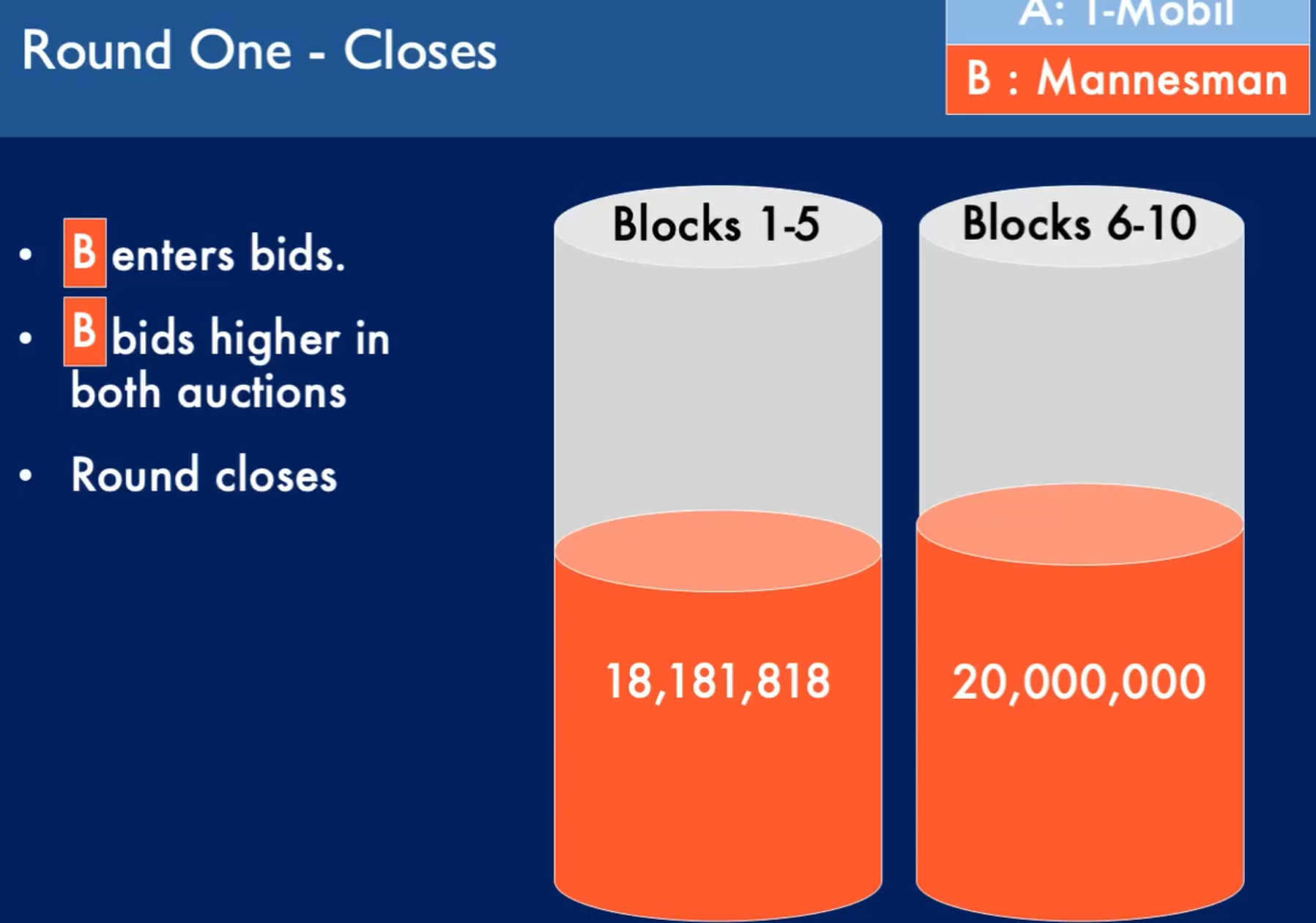

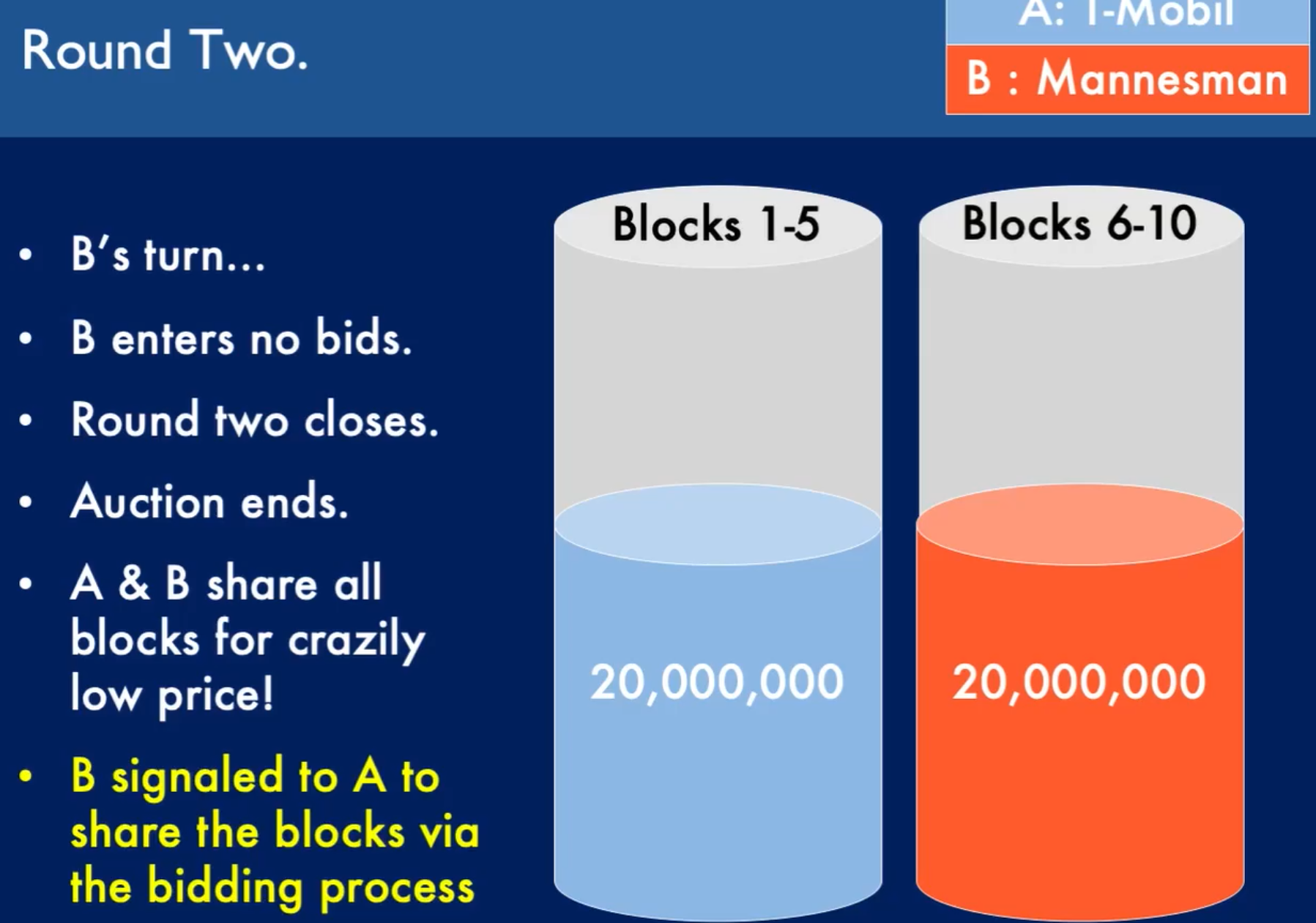

Open auctions help facilitate collusion through bids. E.g: In 1999 the German government were trying to sell 10 blocks of RF spectrum through simultaneous ascending auctions, in rounds. There were realistically only two major bidders in this.

The auction had a rule that any new bid must exceed the previous high bid by 10%.

Disintermediation

In the 90s it was predicted that small businesses would no longer need intermediaries to sell their products and services because the cost of reaching customers directly would be dramatically reduced. This did not happen because the cost of getting people’s attention increased, as there were many companies competing for attention.

Instead, a new kind of intermediary arose - the online marketplace.

Helped by the Network Effect and lock-in, the online marketplace tends towards monopoly.

Q: How does the ebay time limit affect bidder behaviours?

A: It tends to lead to a rush of last minute/second bidding. The problem with sniping is if everyone does it, it results in lower prices for the item.

Q: How does the ebay time limit affect bidder behaviours?

A: It tends to lead to a rush of last minute/second bidding. The problem with sniping is if everyone does it, it results in lower prices for the item.

Two Solutions

Get everyone to use a sniper

Ebay introduced a “proxy” bidding functionality - enter your maximum value and the proxy will bid on your behalf up to that value. If everyone uses this, the auction basically becomes a Vickrey auction.

Extend the deadline whenever a bid is placed

Turns it into an English auction, this is the approach used by Amazon when they tried to enter the market.

Google ad auctions are not based purely on bid price, but also the quality of the advert.

In the early days, google used a first-price auction. They noticed bidders would load the servers by constantly monitoring the system to work out if they could reduce their bid. This was solved by moving to SPSB.

Reverse Auctions

Used by suppliers trying to meet a contract. They offer lower and lower prices and the lowest price wins.

Double Auctions

What happens if we put an open ascending auction and a reverse auction together? Sellers offer decreasing prices and buyers make increasing bids until the values meet.

Continuous Double Auction

Dark Pools

Making large trades in a market often causes the price to go down as other traders assume you have some information causing you to sell such a large quantity. Because of this, “dark pools” have emerged - markets where the orders are hidden from participants. Dark pools started to appear in the 80s.

Dark pool matching can be roughly categorised into two types: scheduled, where crosses occur at fixed times, and continuous, where crosses occur immediately. Over time as technology and latency has improved, dark pools have mostly moved from scheduled to continuous.

Cards

Q: What is the technical term for an English auction? A: Open, ascending-price auction.

Q: What is the technical term for a Dutch auction? A: Open, descending-price auction.

Q: What is the advantage of a Dutch auction over an English auction? A: It’s much quicker to run.

Q: What is a common use of first-price sealed bid auctions? A: Property sales in Scotland.

Q: What is the technical term for a Vickrey auction? A: Second-price, sealed bid auction.

Q: What kind of price discrimination do auctions provide? A: Perfect first-degree

Q: When are auctions used? A: When the seller is unsure of the value that buyers attach to a good.

Q: What does the independent model of bidder values describe? A: Knowledge of other bidders’ values does not affect an individual bidder’s value. Most plausible for products that will be consumed, e.g. food.

Q: What does the interdependent model of bidder values describe? A: Bidders estimate the value of something based on private information, and this may include guessing other bidders’ values. Most plausible for objects that might be re-sold later.

Q: Why are SPSB and English auctions considered weakly equivalent? A: They are only strategically equivalent if values are independent.

Q: What is an incentive compatible auction? A: An auction that encourages bidders to bid their true value.

Q: Which auctions are incentive compatible, and which aren’t? A: English and Vickrey are, Dutch and FPSB are not - since the optimal strategy is to shade.

Q: What does the Revenue Equivalence Theorem state? A: If values are independent, and all bidders are risk neutral, then any standard auction yield the same revenue.

Q: What does a bidder being risk neutral mean? A: Means that the bidder does not care if they miss out on the sale.

Q: What is a standard auction? A: Any auction where the bidder with the highest bid wins.

Q: What are two key implicit assumptions of the Revenue Equivalence Theorem? A: All auctions are equally attractive, there’s no collusion between bidders.

Q: What’s an example of collusion between bidders? A: T-Mobi land Mannesman colluding to split the German RF spectrum for a low price.

Q: What was the disintermediation theory? A: In the 90s it was predicted that small businesses would no longer need to sell through intermediaries due to being able to reach customers directly on the internet. This was not true, as the cost of getting peoples’ attention increased, resulting in online marketplaces.